Shares trading

$0 commission on all global shares, including ETFs

Experience ultra-fast execution¹, with no partial fills

Dedicated customer service available 24/5

- Est. 1989

- 1.5m+ global traders and investors¹

- LSE listed*

2025 WINNER

No.1 Commissions & Fees

ADVFN International Financial Awards

2024 WINNER

Best Mobile Trading Platform

ForexBrokers.com Awards

2023 WINNER

Best Forex Broker

Good Money Guide Awards

What is shares trading?

Shares trading, also known as stock trading, is the process of speculating on the price movement of publicly trading companies.

With us, you can trade on shares via CFDs, which allow you to go long if you think a share price will rise, or go short if you think that it’ll fall, without taking ownership of the underlying stock.

Apple Inc

304.34

0.15%

Microsoft Corp

705.35

-0.09%

Tesla Inc

487.63

-0.52%

Amazon.com Inc

326.32

0.11%

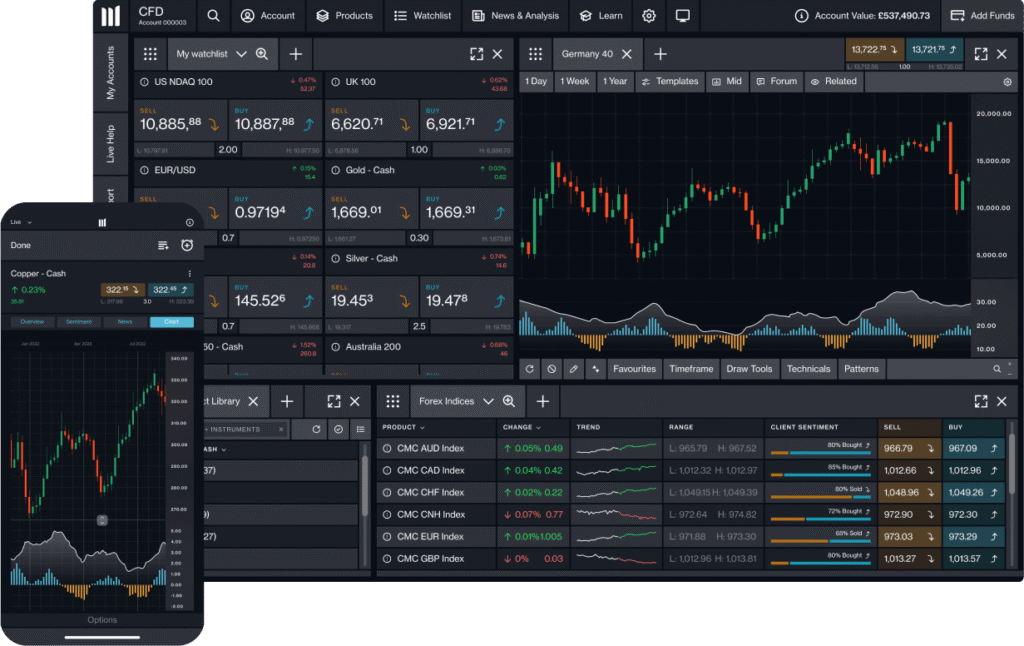

Why open a CFD trading account with us?

Your favourites in one place

Trade CFDs on over 9,000 shares, including top US and Canadian stocks, Hong Kong market leaders, European blue chips, and UK favorites.

Professional research

Get free access to quantitative equity analysis from Morningstar.²

Minimal slippage

With fully automated, lighting-fast execution in 0.0040 seconds³.

A regulated broker

You’re in safe hands – we’re regulated by Canadian Investment Regulatory Organization (CIRO).

Dedicated customer service

Experienced customer service available 24/5 in EN, FR, and ZH, to support you in your trading.

$0 commission on all global shares

Trade 9,000+ global shares with $0 commissions, whatever the size of your trade.

Indices trading costs

Trade on more than 80 stock index instruments⁵, based on major US, Canadian, European, Asian and African indices.

Pricing is indicative. Past performance is not a reliable indicator of future results.

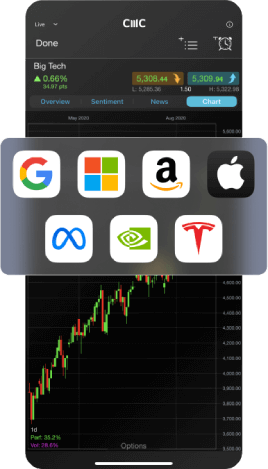

Trade 80+ US shares in extended hours

Speculate on over 80 popular US stocks. Go long or short on Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla and more from 4:00 AM to 8:00 PM EST, before the US stock exchange opening at 9:30 AM EST.

React early to earnings reports, breaking market news and global events

Manage your existing positions in pre- and post-market trading

Enjoy a seamless trading experience, with access to the same order types and execution

FAQs

New to share trading?

What is share trading?

Share trading in the underlying market involves buying and selling company shares, with the aim of making a profit. Shares represent a portion of ownership of a public company. With us, you can trade CFDs on shares, without actually owning the underlying share.

What is leveraged trading?

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

How does trading share CFDs actually work?

When you trade CFDs on shares on our platform, you don’t buy or sell the underlying share. Instead, you’re taking a position on whether you think the company’s share price will go up or down.

With CFD trading, you buy or sell a number of units for a particular instrument. For every point or unit that the price moves in your favour, you gain multiples of your stake, and vice versa.

What's the difference between trading CFDs and share trading?

The main difference between CFD trading and share trading is that you don’t own the underlying share when you trade on a share CFD. With CFDs, you never actually buy or sell the underlying asset that you’ve chosen to trade, but you can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional share trading, you enter a contract to exchange the legal ownership of the shares for money, and you own this equity.

What are the extended trading hours for share CFDs?

You can trade CFDs commission-free on over 80 US shares, including the ‘magnificent seven’ of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, in the pre-market session from 4 AM EST right through to the close of the post-market session at 8 PM EST Monday to Thursday, and from 4 AM to 5 PM EST on Friday.

The core or main US session trading hours, when the New York Stock Exchange and NASDAQ are open, is 9:30am to 4pm (Eastern time).

Are there additional risks when trading during extended hours?

Yes, there is a higher risk when you trade outside of the core trading session hours (when the underlying exchange is closed). There is likely to be a greater level of price volatility, due to lower trading volumes. This is because there are fewer participants than during normal market hours, resulting in less liquidity, which means that markets are more volatile as a result.

These market conditions mean that prices are likely to fluctuate more rapidly than usual, and some trades could be more difficult to execute, owing to the lower trading volumes. Our spreads may also be wider compared with the main trading session.

Our order types and execution function as normal during extended-hours trading, although we lower trading and position limits compared with the main trading session. This helps us to manage risk during periods of lower liquidity in the market. Account liquidations also function as normal, so it’s important to ensure that your account is properly funded, and that you allow enough time to deposit funds, if required.

New to Bit Blaze?

Is it free to open an account?

There’s no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you’ll need to deposit funds in your account to place a trade.

Is Bit Blaze regulated?

Yes, Bit Blaze Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by Bit Blaze Canada Inc. acting as principal.

How does Bit Blaze protect my money?

As a Bit Blaze client, your money is held separately from Bit Blaze’s own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of Bit Blaze Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

How does Bit Blaze make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

What can I trade on with Bit Blaze?

You can trade on 11,000+ financial instruments when you trade CFDs with us. Take a look at our popular markets and instruments.

Dive deeper

What is share trading?

Explore how share trading works and how you can buy and sell shares of publicly listed companies.

How to trade shares

Learn the essential steps to start trading shares, from researching companies to placing your first trade.

CFD TRADING

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.