ETF trading

- Trade on 1,000+ exchange-traded funds on our award-winning platform¹

Enjoy $0 commission on all global ETFs (including US)

Access lightning-fast execution² and experienced customer service

Free access to Morningstar’s quantitative equity analysis³

- Est. 1989

- 1.5m+ global traders and investors¹

- LSE listed*

2025 WINNER

No.1 Commissions & Fees

ADVFN International Financial Awards

2024 WINNER

Best Mobile Trading Platform

ForexBrokers.com Awards

2023 WINNER

Best Forex Broker

Good Money Guide Awards

What are ETFs?

Exchange-traded funds (ETFs) are a type of investment vehicle that track the performance of a broad collection of underlying assets, such as shares, commodities, and bonds.

ETF portfolios are held by corporations that issue shares (a portion of ownership) in the fund. These shares give investors exposure to the underlying assets as a collective.

ARK Innovation ETF

95.27

0.92%

iPath Series B S&P 500 Short-Term Futures ETN

75.73

0.73%

VanEck Semiconductor ETF

392.75

-0.11%

Invesco QQQ Trust Series 1

796.82

-0.20%

Why trade ETFs with us?

Your favourites in one place

Over 1,000 ETFs to trade, including the most popular themes from the US and Canada.

Professional research

Get free access to quantitative equity analysis from Morningstar.⁴

Minimal slippage

With fully automated, lighting-fast execution in 0.0040 seconds².

A regulated broker

You’re in safe hands – we’re regulated by Canadian Investment Regulatory Organization (CIRO).

Award-winning technology¹

Our recent awards include ‘No.1 Web Platform Platform’ and ‘Best Mobile Trading Platform’.

Competitive pricing

Enjoy commission-free trading for all global share CFDs including ETFs.

Powerful technology you can rely on

2023 WINNER

No.1 Web Platform

ForexBrokers.com Awards

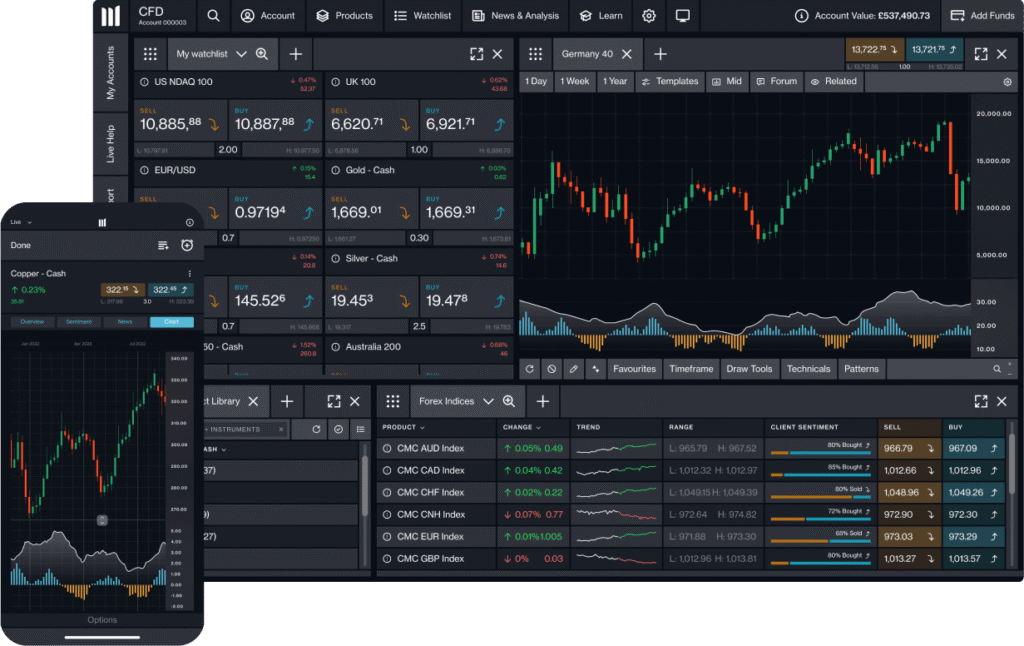

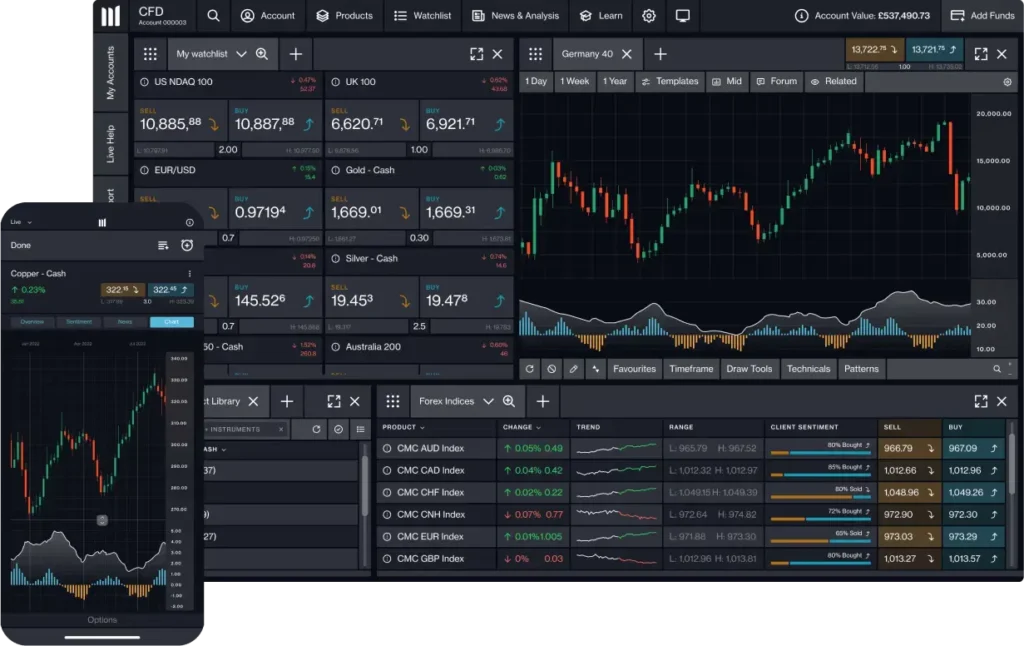

Bit Blaze platform

We’ve invested over £100m into our award-winning platform¹, creating pioneering technology that suits all styles of trading.

2024 WINNER

Best Mobile Trading Platform

ADVFN International Financial Awards

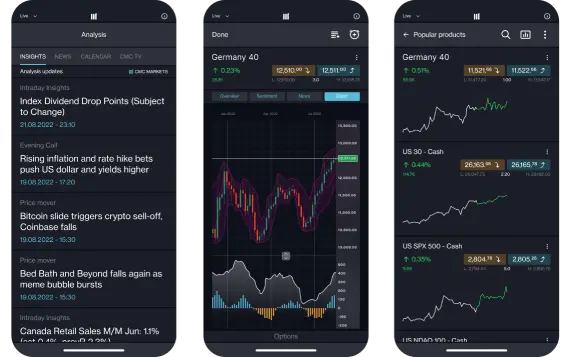

Mobile app

Get the functionality of our web platform in your pocket with mobile-optimized charting, full order-ticket features and real-time alerts

Spread your wings - switch to Bit Blaze

We’re trusted by global financial service providers, including tier-one banks and brokers. Switch your account to Bit Blaze and benefit from our institutional-quality technology.

- 11,000+ financial instruments

- 1.5 million+ global traders and investors⁸

- 35 years’ experience

Dive deeper

What is ETF trading?

Explore how ETF trading works and how you can speculate on funds that track various assets or indices.

How to trade ETFs

Learn the steps to start trading ETFs, from selecting the right fund to placing your first trade.

10 high dividend ETFs to watch

Discover the top 10 high-dividend ETFs to watch.

FAQs

New to forex trading?

How does CFD trading on ETFs work?

When you trade CFDs on ETFs through our platform, you don’t buy or sell the underlying ETF. Instead, you’re taking a position on whether you think the ETF price will go up or down.

With CFD trading, you buy or sell a number of units for a particular instrument. You gain for every point or unit that the price moves in your favour, and vice versa.

What is leveraged ETF trading?

One of the advantages of CFD trading is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading ETFs on leverage can also amplify losses, so it’s important to manage your risk.

As an example, let’s say you want to put down a total of $1,000 on your ETF trade. Due to the leverage available with CFD trading (5:1 in this case), you would be able to enter this position with an initial outlay of $200, instead of $1,000. However, remember that your profits and losses are based on the full value of the trade ($1,000). As a retail client, you will never lose more than the amount in your account.

What is leveraged trading?

There are a number of costs to consider when trading on ETFs, including spread costs, holding costs (for trades held overnight) and guaranteed stop-loss order charges (if you use this risk-management tool). View our trading costs for more details.

ETF trading offers better value when compared with trading each individual constituent of an ETF. There’s no cost to opening an account with us, and no minimum deposit.

New to CMC Markets?

Is it free to open an account?

There’s no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you’ll need to deposit funds in your account to place a trade.

Is Bit Blaze regulated?

Yes, Bit Blaze Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by Bit Blaze Canada Inc. acting as principal.

How does Bit Blaze protect my money?

As a Bit Blaze client, your money is held separately from Bit Blaze’s own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of Bit Blaze Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

How does Bit Blaze make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

What can I trade on with Bit Blaze?

You can trade on 11,000+ financial instruments when you trade CFDs with us. Take a look at our popular markets and instruments.

CFD TRADING

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.