Rates and bonds

- Trade on 50+ government bond and interest-rate instruments on our award-winning platform¹

Tight spreads, lightning-fast execution² and dedicated customer support in EN, FR, ZH

Earn up to 25% in trading rebates³ through BitBlaze ALPHA

- Est. 1989

- 1.5m+ global traders and investors¹

- LSE listed*

2025 WINNER

No.1 Commissions & Fees

ADVFN International Financial Awards

2024 WINNER

Best Mobile Trading Platform

ForexBrokers.com Awards

2023 WINNER

Best Forex Broker

Good Money Guide Awards

What is commodity trading?

Commodity trading is the buying and selling of raw materials, or primary agricultural products, such as oil and gas, precious metals such as gold and silver, and soft commodities like cocoa, coffee, wheat and sugar.

When you trade CFDs on these commodities, you’re speculating on the price of these raw physical assets, without taking ownership of the underlying asset.

UK Gilt - Cash

138.99

-0.08%

Euro Bund - Cash

196.32

0.05%

Euribor - Cash

147.01

0.01%

US T-Bond - Cash

170.05

0.19%

Why trade bonds with us?

50+ global rates & bonds

Trade CFDs on interest rates and government debt obligations, such as gilts, bonds, bunds and treasury notes.

Minimal slippage

With fully automated, lighting-fast execution in 0.0040 seconds⁵.

A regulated broker

You’re in safe hands – we’re regulated by Canadian Investment Regulatory Organization (CIRO).

Precision pricing

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Dedicated customer service

Experienced customer service available 24/5 in EN, FR, and ZH, to support you in your trading.

Trade out of hours

Favourites like the US 30 and US 100 trade 24/5, so you don’t have to stop when the markets do.

Powerful technology you can rely on

2023 WINNER

No.1 Web Platform

ForexBrokers.com Awards

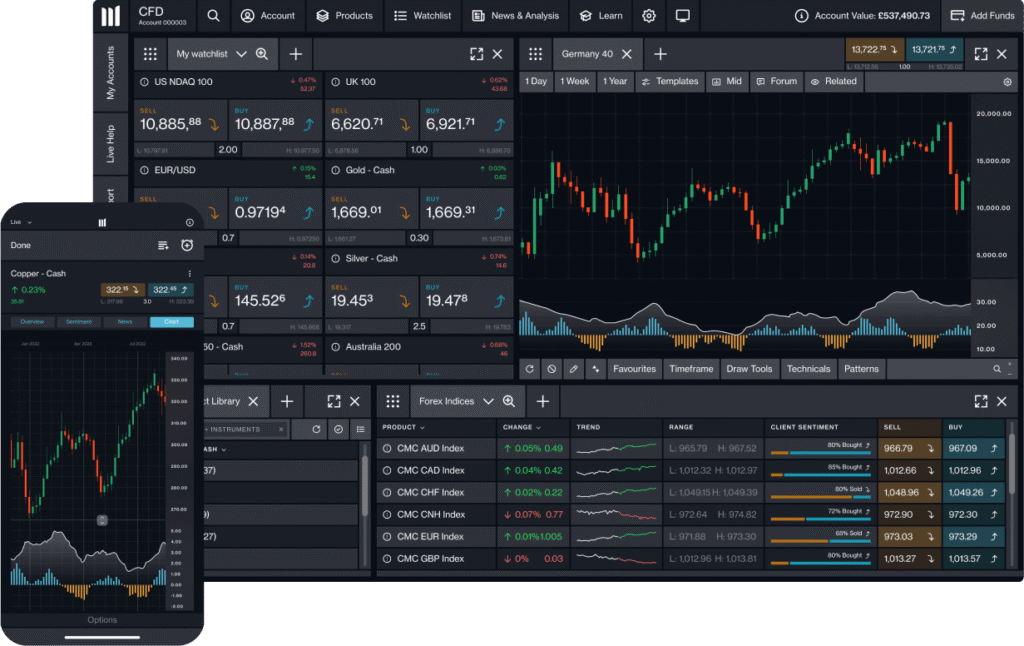

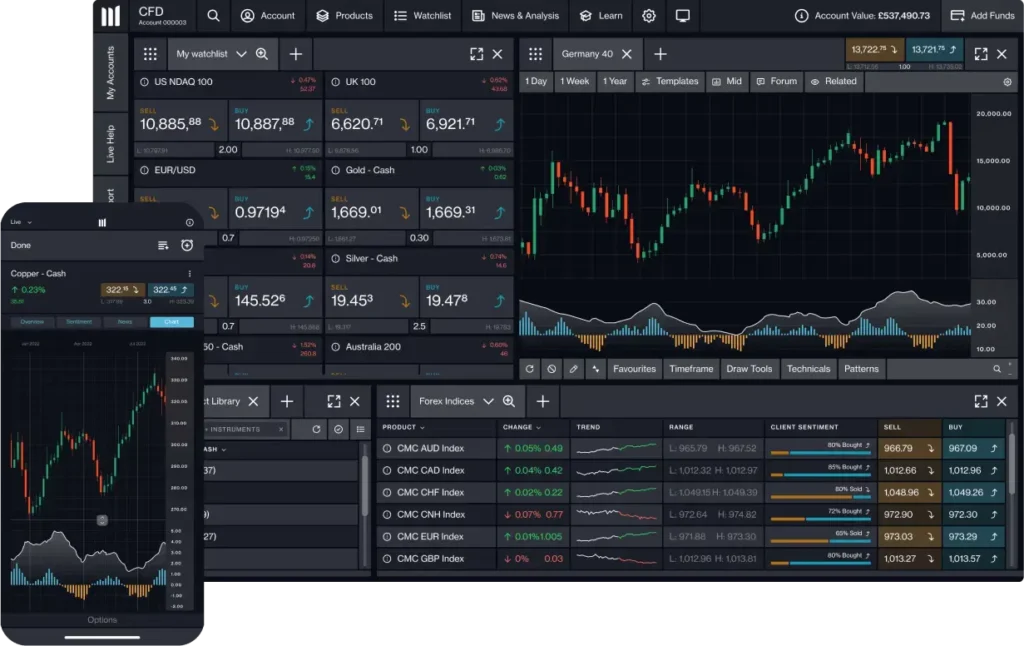

Bit Blaze platform

We’ve invested over £100m into our award-winning platform¹, creating pioneering technology that suits all styles of trading.

2024 WINNER

Best Mobile Trading Platform

ADVFN International Financial Awards

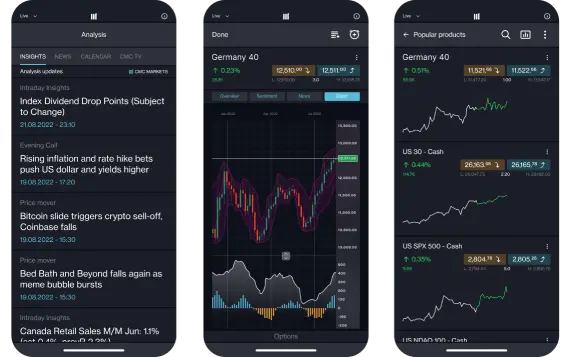

Mobile app

Get the functionality of our web platform in your pocket with mobile-optimized charting, full order-ticket features and real-time alerts

Spread your wings - switch to Bit Blaze

We’re trusted by global financial service providers, including tier-one banks and brokers. Switch your account to Bit Blaze and benefit from our institutional-quality technology.

- 11,000+ financial instruments

- 1.5 million+ global traders and investors⁸

- 35 years’ experience

Dive deeper

What is bonds trading?

Learn how bonds trading works and why traders trade debt securities.

FAQs

New to forex trading?

What are bonds?

A bond is a fixed-income instrument, or debt security, and represents a long-term lending agreement between a borrower and lender – effectively an ‘IOU’. The bond issuer is often a corporation or a government, and the funds are used to finance a project or operation.

What are the costs of trading on treasuries?

There are a number of costs to consider when CFD trading, including holding costs (for trades held overnight, which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs (on expiring forward positions) and a guaranteed stop-loss order (GSLO) charge (if you use this risk-management tool).

What is leveraged trading?

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

New to Bit Blaze?

Is it free to open an account?

There’s no cost when opening a live trading account with us. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you’ll need to deposit funds in your account to place a trade.

Is Bit Blaze regulated?

Yes, Bit Blaze Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO). CFDs are distributed in Canada by Bit Blaze Canada Inc. acting as principal.

How does Bit Blaze protect my money?

As a Bit Blaze client, your money is held separately from Bit Blaze’s own money and is held on trust in segregated bank accounts with a Canadian bank. This account is opened and maintained in the name of Bit Blaze Canada Inc. We do not use client money to hedge our positions or to meet the trading obligations of other customers. This offers you financial security and you can rest assured that your money with us is protected.

How does Bit Blaze make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

What can I trade on with Bit Blaze?

You can trade on 11,000+ financial instruments when you trade CFDs with us. Take a look at our popular markets and instruments.

CFD TRADING

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.